What are the conditions for opening a pharmacy or drugstore?

There are several forms of drug retail, such as: drug dealers of enterprises, medicine cabinets of health stations, and retailers of traditional medicine and herbal medicines. And the two most common forms of drug retail are: pharmacies and different drugstores. These two models have different regulations on conditions for opening drugstores, pharmacies, professional managers, powers, scope of activities, etc.

Standard pharmacy business model

Various pharmacies and drugstores

Regarding the similarity, pharmacies and drugstores are both drug retailers, operating under the management of the State and must comply with the regulations of the Pharmaceutical industry.

In addition, different pharmacies and drugstores are divided according to 4 criteria. Specifically:

- Person in charge of expertise: The condition for opening a pharmacy is a person who has a professional degree, graduated from a university in pharmacy, in charge. A pharmacy is a person who has a college diploma in pharmacy or an intermediate degree in pharmacy and must have at least 18 months of professional practice at a pharmacy.

- Scope of operation: Pharmacies can retail finished drugs and prepare prescription drugs. Drugstores can only retail finished drugs.

- Location of operation: Pharmacy can open in any location. Conditions for opening drugstores are in districts, communes, suburban districts, suburbs of provinces and centrally run cities. Note, with new areas being moved from communes, townships to wards, if there is not enough facility to serve 2,000 people, they may continue to open new drugstores operating for no more than 03 years from the date the area is transferred. change.

- Changing prescription drugs: With Pharmacies, Pharmacists have the right to change drugs in prescriptions with drugs with similar effects on the condition of consent of the purchaser. With the pharmacy, it is not allowed to change the medicine in the prescription.

Conditions for opening pharmacies and drugstores

Opening drugstores, drugstores with conditions prescribed by law

Pursuant to the law that clearly stipulates the conditions for opening a pharmacy, a pharmacy must meet the following requirements:

- Conditions for pharmacy practice certificates: The grantees must have an intermediate, college or university degree in pharmacy or related to medicine and pharmacy, and be granted a pharmacist degree upon graduation. Must have sufficient professional qualifications and practice time at appropriate pharmaceutical establishments to be eligible.

- Personnel conditions: The responsible head must have all degrees and certificates issued by the Ministry of Health, the personnel must be healthy and working conditions, not infected with infectious diseases, not violating regulations. or banned from practicing medicine and pharmacy in accordance with the law.

- Conditions on facilities and equipment: Must have a standard and clean place, drugs must be kept in a suitable environment and temperature, strictly comply with regulations on fire prevention and fighting, and conditions on environmental sanitation , ensure that the prescribed drug has a clear origin.

Procedures for opening a pharmacy from A – Z

If you want to open a pharmacy business, you need to know the procedures for opening a pharmacy first. And this is clearly stipulated by law in Article 18 of the 2016 Law on Pharmacy, in addition to the requirement of professional qualifications of the person in charge, the conditions for opening a pharmacy, a pharmacy also need the following documents:

- Step 1: Submit application for Certificate of eligibility for pharmacy business

Detailed profiles include:

- An application form for a Certificate of eligibility for pharmacy business – Form No. 4a/ĐN-DĐKKD, Appendix 1 of Circular 10/2013/TT-BYT dated March 29, 2013 (according to a ready-made form prescribed by the Ministry of Health) .

- Technical documents corresponding to different pharmacy business establishments, drugstores and drugstores according to regulations.

- A certified copy of the business registration certificate or the business registration certificate of the individual business household (issued by the district-level People’s Committee).

- Certified copy of pharmacy practice certificate.

All papers and documents to complete the procedure for opening this pharmacy need to be sent to the Department of Health of the province or centrally run city where you reside to be granted a certificate of eligibility for pharmacy business.

Note, according to the conditions for opening a pharmacy, the technical documentation part is prescribed by law with the drug retailer, the application for registration for the standard Good Pharmacy Practice (GPP) inspection (assessment process). GPP pharmacy).

- Step 2: Receipt of application

The agency receives the application and returns the receipt to you. If the application is not enough according to the procedures for opening the country of origin, within 10 days from the date written on the Receipt Form, the receiving agency will send a request for amendment and supplementation for you to make the correct addition. prescribed enough.

- Step 3: Appraise and issue a Certificate of eligibility for pharmacy business

After the dossier is duly completed, the Director of the Department of Health will organize an assessment and issue a Certificate of eligibility for pharmacy business. If the pharmacy does not meet the conditions to open a pharmacy, the pharmacy will reply in writing and should clearly state the reason.

Note about the time limit for assessing the application file and granting a certificate of eligibility to open a pharmacy, pharmacy, etc. is: 20 days from the date of receipt of a complete and valid application. The cost of appraising standards and conditions for pharmacy practice is 1 million VND in accordance with the law in Circular 277/2016/TT-BTC.

Taxes to be paid when opening a pharmacy

In addition to the procedures for opening drugstores and pharmacies, pharmacy owners also need to know about the taxes to be paid when opening a pharmacy.

Trading in drugstores and drugstores in the form of individual business households, distribution and supply of goods. Therefore, it is necessary to pay 3 main taxes including: license tax, personal income tax and value added tax.

Trading in pharmacies and drugstores must pay tax according to regulations

- License tax: Regulations on paying license tax are part of the tax payable when opening a pharmacy. License tax is fixed based on the revenue of the pharmacy. Drugstores and drugstores with revenue of over 500 million VND/year pay taxes 1 million VND/year. Revenue from over 300 million to 500 million VND/year, 500,000 VND/year tax. Revenue from over 100 million to 300 million VND/year, 300,000 VND/year. License tax is paid in the first 6 months of the calendar year. If the business starts within the first 6 months of the year, the license tax will be paid for the whole year. New business in the last 6 months, only need to pay 50% of the tax rate of the whole year.

- Personal income tax: How to calculate personal income tax payable = Rate x Revenue. The rate of personal income tax in the line of distribution and supply of goods is 0.5% for 01 month. If your pharmacy or pharmacy is closed for 15 consecutive days or more in a month, it will be considered for a 50% reduction of the payable tax amount. And if you take a whole month off, you will be considered for tax exemption for that whole month. In order to be considered for deduction/exemption, an application with confirmation from the local People’s Committee is required to be sent to the Tax Sub-Department where your drugstore tax is managed.

- Value-added tax: Tax payable when opening a pharmacy includes value-added tax calculated and paid at a stable flat rate of 6 months or a tax rate calculated directly on the basis of monthly or quarterly income declaration. Value added tax calculation formula = Rate x Revenue. Value-added tax calculation rate is 1% for drugstore and pharmacy business. Value added tax shall be paid quarterly at the latest within the first 30 days of the following quarter.

Note, if the pharmacy has a turnover of 100 million VND/year or less, it does not need to pay two types of tax, value added tax and license tax. If the pharmacy turnover is over 100 million VND/year, tax will be calculated according to all 3 types as above.

GPP pharmacy evaluation process

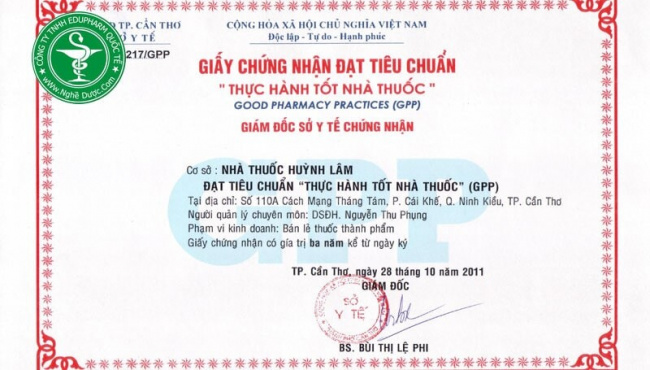

In the condition of opening drugstores, there are regulations on GPP standards. GPP stands for Good Pharmacy Practices which means “Good Pharmacy Management Practice”. GPP is a combination of both professional and ethical principles in professional practice in the pharmacy. The GPP pharmacy evaluation process is the final standard in the entire system of drug quality assurance processes to help improve the quality, effectiveness of treatment and ensure safety for the community.

Certificate of GPP standard

The GPP pharmacy assessment process issued by the Minister of Health with specific steps includes:

- Step 1: The audit team announces the decision to establish the audit team, its purpose, content and expected plan

- Step 2: The drug retailer presents a summary of the GPP application process, organization and personnel, and specific contents of the audit.

- Step 3: Based on the actual assessment of the implementation of GPP standards at retail establishments, the evaluation team will evaluate each specific content.

- Step 4: The assessment team meets with drug retailers (drugstores, drugstores) and informs and discusses the assessment of meeting GPP standards.

- Step 5: Make a record of GPP assessment and sign the minutes. The minutes must classify the level of meeting GPP standards, list the points that the pharmacy needs to fix, if any, compare the provisions in the regulations together with the corresponding graded checklist and the contents that have not yet been corrected. agreement between the assessment team and the drug retailer. The head of the assessment team and the owner of the drug-retail establishment sign and certify to keep 01 copy at the drug-retailer and 02 copies at the Department of Health.

This assessment will be carried out every 3 years, excluding ad hoc audits. Every November, the Department of Health publishes a plan to periodically evaluate the compliance with GPP standards of drug retailers in the following year.

summary

Procedures and conditions for opening drugstores and pharmacies belong to administrative procedures, there are clear regulations but need a lot of paperwork for those who are inexperienced, it will be more or less embarrassing. Therefore, we hope that the contents of conditions and procedures for opening a pharmacy as well as a note on taxes when opening a pharmacy, the GPP standard assessment process, etc. will support you to do these procedures smoothly. share more.

FAQ

- What does an application for a pharmacy store license include?

- Records include:

- An application form for a certificate of eligibility to practice according to the form

- Practice certificate of the person in charge of the establishment (Including: professional diploma, curriculum vitae, health examination sheet, certificate of practice time at a lawful pharmacy establishment). All are valid copies.

- Certificate of pharmaceutical business registration (Valid copy)

- Professional and technical profile, personnel organization

- Where do I submit an application to open a pharmacy or pharmacy?

Submit the application at the one-stop department of the Department of Health of the province or city directly under the Central Government. Some provinces and cities will receive dossiers at the People’s Committees of provinces and centrally run cities.

- After submitting the application, how long will the Department of Health organize the assessment?

The Department of Health will organize an assessment within 20 days from the date of submission of complete and valid documents

Posted by: Tan Do Minh

Keywords: Summary of detailed information on conditions for opening a pharmacy