Our country is increasingly developing, everyone wants to have a home, whether small or big, to meet the needs of low-income people, so the State has established social housing.

The following article will help you better understand the conditions for buying social housing in Ho Chi Minh City and Hanoi in 2023.

What is social housing?

Social housing is a type of housing owned by state agencies, non-profit organizations or types of houses owned and managed by the state built with the purpose of helping officials and workers. public employees who do not have stable housing, low-income people who are subject to the provisions of law.

Social housing is invested in and built by the State or organizations and individuals for the subjects as prescribed by law. This is a type of great contribution in economic development, social significance for people, especially those with low income.

In the past, people did not know much about social housing, so they often thought that social housing was a type of temporary and collapsed apartment building, but now social housing projects are increasingly being built by investors. building scale, cleanliness, quality should be of interest to many people, many people are looking to learn about the conditions to buy a house in a synagogue.

Regulations on subjects eligible to buy social housing

Currently, according to the provisions of the Law on Housing 2014, there are 10 groups of subjects who are entitled to social housing support policies. In which priority is given to the following subjects:

– People with meritorious services to the revolution;

– Poor and near-poor households in rural areas; having no house or having a house with an equally divided area of less than 8 square meters per person.

– Households in rural areas are often affected by natural disasters and climate change;

– Low-income people, poor and near-poor households in urban areas.

In addition to the above subjects, the following subjects are also given priority to buy social housing:

– Officers, professional non-commissioned officers, professional and technical non-commissioned officers, professional soldiers, workers in agencies and units of the People’s Police and the People’s Army;

– Officials and civil servants;

– Households and individuals subject to land recovery and having to clear or demolish their houses in accordance with law but have not yet been compensated by the State with houses or residential land…

Conditions for borrowing to buy social housing

– Have permanent residence or KT3 in the place where the social housing project is located and have paid Social Insurance for more than 1 year.

– Only conduct loans with social housing purchase contracts signed with investors after January 7, 2013.

– Do not have to pay personal income tax regularly due to the low income of less than 9 million VND per month and the need to buy social housing with suitable reasons.

– Borrowers to buy social housing actually do not have a house or have a house but the land area used is less than 8 square meters per person and must have a certificate from the local government.

– Be sure to have collateral when applying for a home loan, which can be mortgaged with the apartment itself or pre-existing property.

– When borrowing to buy a social house and the debt is due before maturity, there will be a penalty of 2% of the total amount of loan repayment.

– Types of housing applied for a loan to buy guarantee are social housing, commercial housing being converted into social housing, with an area of less than 70m2 and a selling price of less than 15 million per square meter.

– Buyers need to sign a purchase and sale contract with the investor before applying for a social housing loan and submitting documents to the Bank.

– Borrow to buy social housing in 2017

– Borrowers ensure to have a stable job and income.

Conditions for enjoying social housing support policies

In order to be supported to buy social housing, the above subjects must meet the following conditions: Housing, residence and income conditions, including:

– Have not had a house under their ownership, have not bought, rented or rented-purchased social housing;

– Not yet enjoying the policy of housing support, residential land in any form at the place where they live, study or have a house under their ownership but the housing area per capita in the household is lower than that of the household. The minimum housing area is regulated by the Government from time to time and from region to region.

– Must have permanent residence registration in the province or centrally run city where the social housing is located;

– If there is no permanent residence registration, they must have a temporary residence registration for one year or more in that province or city.

– For cadres and civil servants, they must not have to pay regular income tax according to the provisions of the law on personal income tax;

– If they are poor or near-poor households, they must be poor or near-poor according to the Prime Minister’s regulations.

Current social housing buyers

According to Article 49 of the Law on Housing 2014, there are 9 subjects who can buy social housing. Specifically, people with low incomes, poor and near-poor households in urban and rural areas, people working in police units and the people’s army, people with meritorious services to the revolution, workers who work for In industrial zones, finally, households are subject to site clearance and land acquisition for construction but have not yet been compensated.

Conditions for buying social housing: There are 3 conditions for buying social housing according to state regulations that people need to know as follows:

Residence conditions: If you have a need to buy social housing in the area where the social housing project is located, you must have a permanent residence. If you do not have a permanent residence, it is mandatory that you have a temporary residence permit at the place where the social housing project is located. In addition, you must have social insurance, a labor contract of 1 year or more in the province or locality where the synagogue house project is located.

If you are subject to resettlement, you must ensure the conditions prescribed by the province or locality where the social housing project is located.

Housing conditions: According to the provisions of the Law on Housing, Article 51, you must be a person who is having difficulty in housing, specifically as follows:

+ Subjects must rent, borrow or stay at other people’s houses because they do not have houses. You have not purchased or rented social housing from other projects.

+ The subject has a house but has been revoked by the state because of ground clearance for projects implemented by the state, or the place where you live is being degraded and the state has not yet compensated you for your residence. other.

+ Subjects who have not been given houses of love or gratitude according to the category of people with meritorious services to the revolution, have not yet enjoyed the housing policy in the place where you live.

In addition, you already have housing under your ownership such as run-down, cramped housing that does not meet your needs. (According to regulations, the land area of the household is 10m2/floor/person)

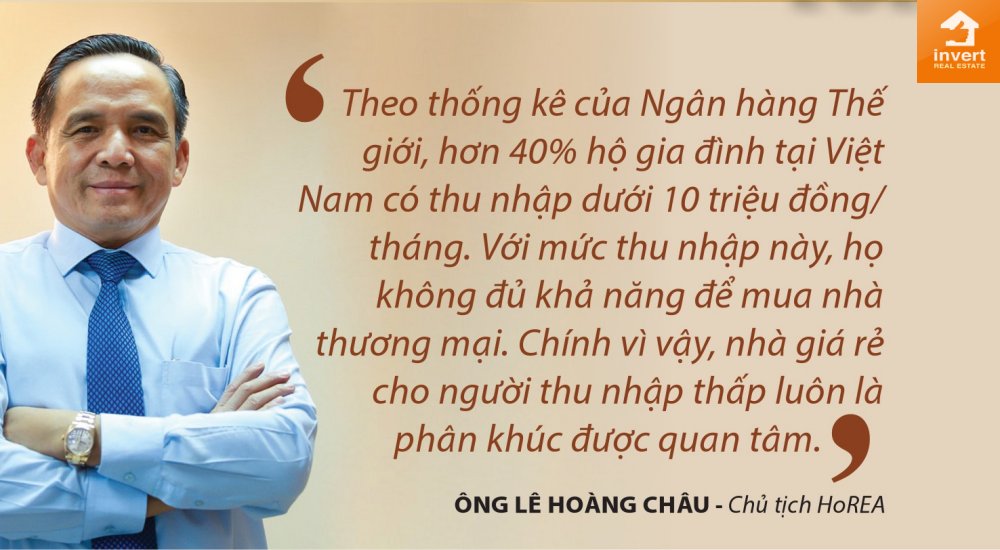

Income conditions: You are a low-income person who is not subject to regular personal income tax. Subjects are people in households with a local certificate of being poor or near-poor.

The purpose of building social housing is to meet the housing needs of low-income people, so this condition is very important and essential in the condition of buying social housing that everyone needs to know.

In 2022, buyers of social housing will still be able to borrow at an interest rate of 4.8%/year

The State Bank has just issued Decision No. 1956/QD-NHNN on the interest rates applied by commercial banks in 2022 for outstanding loans for housing support in accordance with Circular No. 11/2013/TT-NHNN dated May 15, 2013, Circular No. 32/2014/TT-NHNN dated November 18, 2014 and Circular No. 25/2016/TT-NHNN dated July 29, 2016.

Accordingly, the interest rate of commercial banks applied in 2022 for outstanding loans of housing loans as prescribed in Circular No. 11, Circular No. 32 and Circular No. 25 is 4, 8 years. This interest rate is unchanged from 2021 but has decreased by 0.2 percentage points compared to 2019 and 2020.

Remove interest rate incentives when borrowing to buy and rent social housing

From January 20, 2022, Circular 20/2021/TT-NHNN amending Circular 25/2015/TT-NHNN guiding concessional loans for implementation of social housing policy takes effect. which has removed the interest rate incentives when borrowing to buy and rent social housing.

Specifically, Circular 20/2021/TT-NHNN has removed regulations on interest rate incentives when borrowing capital to buy, rent, or lease-purchase social housing; From January 20, 2022, beneficiaries of preferential loans for implementation of social housing policies include:

– Borrowers for investment in social housing construction specified in Clause 1, Article 15 of Decree No. 100/2015/ND-CP.

– Borrowers for new construction or renovation or repair of residential houses specified in Clause 1, Article 16 of Decree No. 100/2015/ND-CP.

Time to transfer, buy and sell social housing

Pursuant to Article 62 of the Law on Housing 2014, the rental, lease-purchase and sale of social housing must comply with the provisions of this Law; At the same time, each entity specified in Clause 1, Article 50 of the Law on Housing 2014 and Decree 100/2015/ND-CP on development and management of this housing may only rent or lease purchase or purchase one house. in society; For students at public ethnic boarding schools, they do not have to pay rent for housing and services during use.

– The minimum term of the social housing rental contract is 5 years;

– The minimum payment term for rent-purchase of social housing is 5 years from the date of signing the lease-purchase contract.

The lessee or hire-purchaser of social housing may not sell, sub-lease or lend the house during the rental or lease-purchase period; if the lessee or lessee no longer needs to rent or lease-purchase the house, the contract shall be terminated and the house must be returned.

The lessee or the purchaser of a social house may not resell the house for a minimum of 5 years from the time of full payment of the rent and purchase price; In case, within 05 years from the date the purchaser or lessee has fully paid for the purchase or lease purchase of a house and wishes to sell this house, it may only resell it to the social housing management unit. or sell to subjects eligible to buy social housing if this unit does not buy at the maximum selling price equal to the selling price of the same type of social housing at the same place and time of sale and does not have to pay personal income tax. core.

Procedures to meet the conditions for buying social housing

- Application to buy social housing;

- Attestation records of the subject and the status of your housing in the locality where you live;

- Documents proving your residency status;

- Records proving your income.

Benefits and some notes to meet the conditions for buying social housing

Benefit: Social housing brings economic benefits, ensures social security, helps meet the needs and dreams of owning a house in your name. Social housing also stimulates the growth of construction and interior industries.

According to Minister Trinh Dinh Dung, “Investing in social housing is not only beneficial in terms of society but also economically. It not only helps people have houses, but also creates economic development. This is a construction investment channel.”

In addition, social housing also contributes to the increase in the value of real estate and consumption of the area because it attracts the number of homebuyers to live here.

Some social housing in 2020 in Ho Chi Minh City such as: social housing in District 9, District 10, District 12, Binh Tan District, River Tower social housing in District 9 and many social housing projects another is under construction.

Some notes you need to know: Social housing mainly meets the needs of low-income people, so only build an area from 25m2 to a maximum of 75m2.

No bank mortgage in any form or only a bank mortgage to buy the apartment itself. Banks can support loans up to 80% of the value of the apartment.

It is not allowed to transfer without meeting the conditions for 5 years from the date of paying off the house purchase price under the signed contract. Or before 5 years need to resell the house, it can only be sold to the State, the investor, or the subjects eligible to buy social housing.

Social housing is being interested by many people, so truongptdtntthptdienbiendong.edu.vn has collected sufficient information on the conditions to buy social housing for those in need. We will bring to you about other types of housing.

999+ free GPT Chat accounts, Acc OpenAI Free 100% successful login